2025 Q1 In Review: The Calm Before the Storm

What we saw:

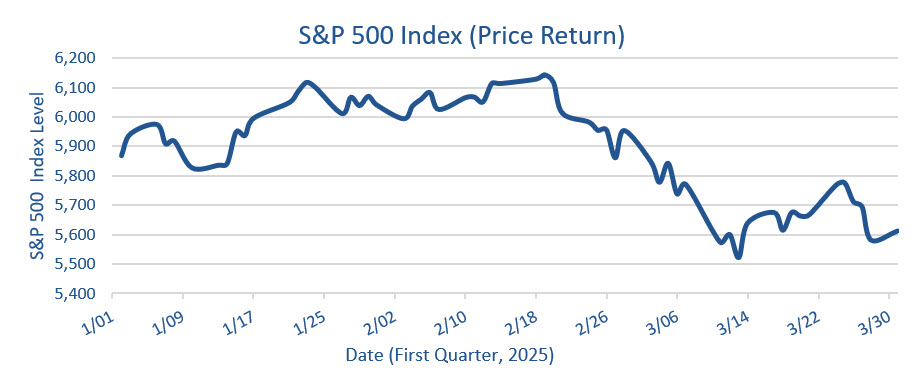

In retrospect, the first quarter of 2025 could be characterized as a relatively calm quarter for U.S. markets. Initially, the S&P 500 Index began the quarter robustly, reaching a peak on January 23rd.[1] The rise appeared to stem from a confluence of factors, including favorable earnings reports from several companies, optimism surrounding potential tax reforms and deregulation measures, as well as the announcement of the Stargate project — a multi-year commitment by several companies to invest in AI (artificial intelligence).

[1] All market data sourced from Bloomberg LP, as of 03/31/2025.

However, subsequent market dynamics shifted, with tariffs replacing AI as a predominant topic of discussion. On February 1st, the government unveiled its initial tariff proposal, encompassing a 25% levy on imports from Canada and Mexico and an additional 10% tariff on Chinese goods. While the S&P 500 Index achieved another high on February 18th and peaked for the quarter the following day, concerns regarding tariffs and potential policy changes seemed to exert downward pressure on market performance. In the ensuing 16 trading days, the index experienced a decline of over 10%, reaching its quarterly low on March 13th. In hindsight, this volatility was light when compared to how Q2 2025 would begin. The quarterly downturn of 4.28% (on a total return basis) marked the first negative quarter for the index since Q3 2023, following five consecutive quarters of upward momentum. From our vantage, the downturn highlighted a shift in market sentiment as participants grappled with heightened uncertainty and growing apprehension regarding trade policy shifts.

What we’re watching:

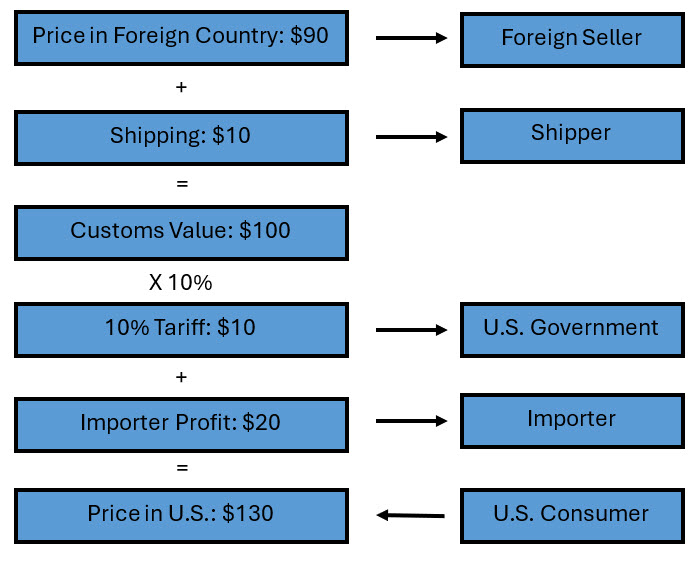

Looking ahead, we feel understanding the operational mechanics of tariffs is crucial. A tariff represents an import tax on goods. When a good is imported to the US, a tariff is levied as the good clears customs. Importers (often US-based entities), bear this cost based on the customs value of the product, which encompasses both the purchase price and associated costs of shipping and packaging. For example, if a product is purchased for $90 in a foreign country, with an additional $10 spent shipping the product to the US, the customs value totals $100. Applying a 10% tariff would result in the importer paying $10 to the US Federal Government when that product goes through customs. The importer may then sell the product to a US consumer at a higher price point, such as for $130 earning $20 profit.

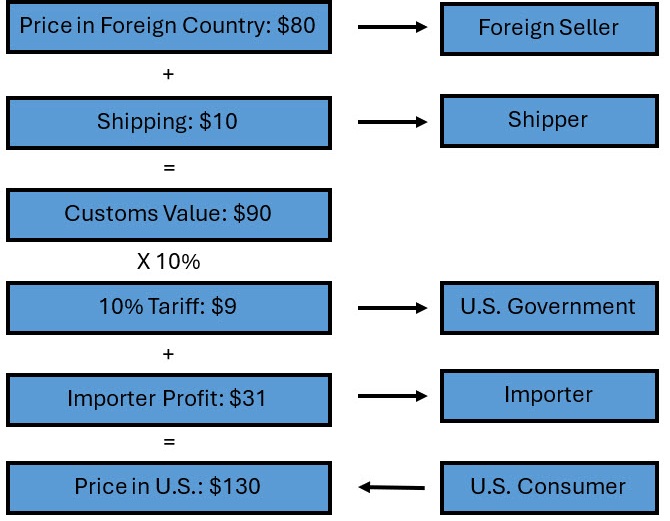

Adjustments within this framework depend on economic conditions and the availability of substitute goods. Generally speaking, an importer will not settle for earning only a $20 profit when it was earning a $30 profit. Something, or more likely multiple things, will adjust depending on the economic conditions. Mechanically, tariff calculations are simple. Predicting the adjustments that will be made in response to tariffs is where much of the debate is. Theoretically, the price impact depends on the type of good and whether it has domestic or tariff-free foreign substitutes. For goods with tariff-free substitutes, the importers may exert downward pressure on foreign sellers to reduce prices. Instead of paying $90 for the good, the importer would be able to say to the foreign seller, the price is $80 or I will find a domestic or tariff-free substitute.

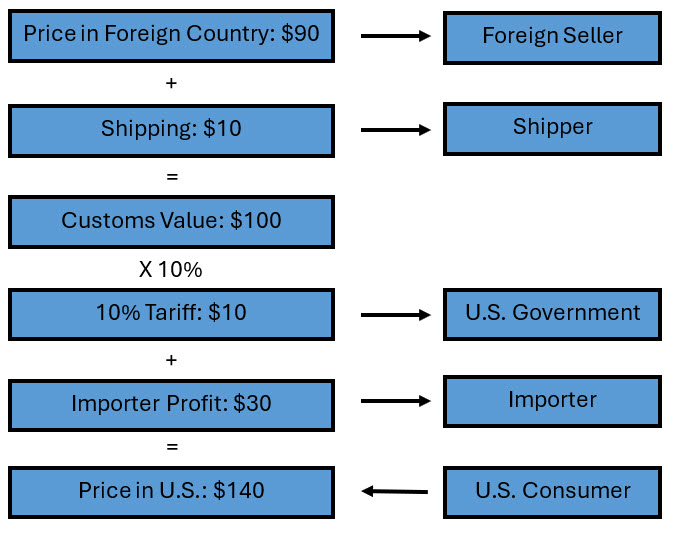

In contrast, for goods lacking alternatives, importers may pass the tariff’s financial burden onto consumers by increasing prices. The importer may adjust the price to $140 for the US consumer to maintain the $30 of pre-tariff profit. In this case, the tariff is effectively paid by the consumer.

These pricing dynamics, however, are intricate, involving concessions from foreign sellers, shifts in importer profit margins, and changes in consumer costs over time. It could easily happen that the foreign seller concedes $2 on price, the importer’s profit drops by $5, and the end consumer pays $3 more. Furthermore, some transactions may become economically unfeasible, particularly if the end consumer choses to forego the purchase entirely, thereby reducing economic activity – a critical recessionary risk.

The introduction of tariffs may create market uncertainty, particularly regarding inflationary pressures and potential reduction in economic activity. These dynamics complicate the Federal Reserve Board’s dual mandate of balancing low inflation with strong employment. Concurrent increases in unemployment and inflation would pose complex challenges and the Fed may not have an obvious answer. In turn, an unpredictable Fed may amplify market uncertainty and unpredictability.

Despite these uncertainties, we do not believe it is all doom and gloom. The financial markets often adopt a forward-looking perspective, and several catalysts remain plausible. For now, many of the negative catalysts seem to be in the rear-view mirror. For example, international negotiations may lead to reductions or cancellations of proposed tariffs. Alternatively, short-term economic activity could increase as importers expedite purchases ahead of tariff implementation, albeit potentially offset by declines in economic activity in later quarters.

While precise outcomes remain uncertain, we believe maintaining a consistent investment strategy during periods of volatility is advisable. Short-term market turbulence may present unique opportunities for investors. As the Barenaked Ladies’ song “Odds Are” suggests, “Odds are, we will probably be all right.”

Should you have any questions or want to discuss potential investment options, please call 1.877.524.9155 or visit SRHfunds.com for more information.

[1] All market data sourced from Bloomberg LP, as of 03/31/2025.

Past performance does not guarantee future results. Investing involves risk, including the loss of principal.

Definitions:

S&P 500 Index: The S&P 500 is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S., designed to measure the overall performance of large-cap U.S. stocks and often used as a benchmark for the broader U.S. equity market performance. One cannot invest directly in an index.