Unveiling the Potential Benefits of Closed-End Fund Discounts

Understanding Discounts and Premiums

CEFs differ from open-end mutual funds in how their shares are priced and traded. Unlike mutual funds, where shares are bought and sold directly at the NAV, CEF shares are traded on stock exchanges. This allows market forces of supply and demand to determine the trading price, which can result in prices deviating from the NAV. These deviations manifest as premiums (when market price exceeds NAV) or discounts (when market price is below NAV).

The reasons behind these pricing disparities are both complex and difficult to measure, influenced by factors such as economic conditions, interest rates, fund performance, and investor sentiment about the asset class. For prospective investors, these discounts can create opportunities to acquire assets at prices lower than their intrinsic value.

The Appeal of Buying at a Discount

Investors purchasing CEFs at a discount can benefit in two key ways:

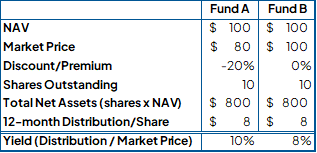

2) Enhanced Income Returns: Distributions from CEFs are often calculated based on NAV but paid out to investors based on the market price. This means buying a fund at a discount can result in a higher yield relative to the purchase price. For instance, a fund offering an 8% distribution on NAV could provide a 10% yield if purchased at a 20% discount.

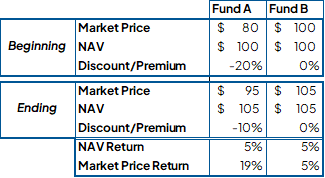

A Hypothetical Example

Consider two funds, both with a NAV of $100 (Exhibit A, below). Fund A trades at a 20% discount ($80 market price), while Fund B trades at NAV. If the NAV of both funds rises by 5% to $105, Fund A’s market price rises to a 10% discount to its NAV, and Fund B maintains no discount, the investor in Fund A would realize a 19% price return, compared to just 5% for Fund B. Similarly, if both funds pay $8 per share in distributions, the yield for Fund A investors would be higher due to the lower purchase price (Exhibit B, below).

Strategic Considerations

While the benefits of discounts are clear, it is important to recognize that market movements and distributions are not guaranteed. Discounts may not narrow, and can even widen further, while distribution rates may change. Nevertheless, for investors who carefully research and select funds, these price dislocations can present a compelling opportunity to enhance returns.

Unlocking the Potential

Closed-end fund discounts offer a unique avenue to potentially increase returns and income. By understanding the mechanics of CEF pricing and leveraging discounts strategically, investors can uncover value in this often-overlooked segment of the market. For more insights on navigating the world of CEFs, visit SRHFunds.com or reach out to info@srhfunds.com to learn more.

This blog is created and authored by SRH Advisors, LLC (“SRH”) and is published and provided for informational purposes only. The opinions expressed in the blog are our opinions and should not be regarded as a description of services provided by SRH or considered investment, legal or accounting advice. Certain information sited is from third-party sources and while we believe the information to be accurate and true to the best of our knowledge, we cannot guarantee its accuracy as there may be certain unknown omissions, errors or mistakes. Use of third-party information, including links, is in no way an endorsement by SRH. The views reflected in the blog are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product or investment strategy is suitable for any specific person. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by SRH), or any non-investment related content, made reference to directly or indirectly in this blog post will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Not all SRH clients and investors will have the same experience within their portfolio(s) and certain topics discussed in this blog may not apply to all clients or investors. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SRH is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of SRH’s current written disclosure statement discussing our advisory services and fees is available upon request.