2024 Q4 In Review: A Quarter of Modest Gains Amid Market Swings

What we saw:

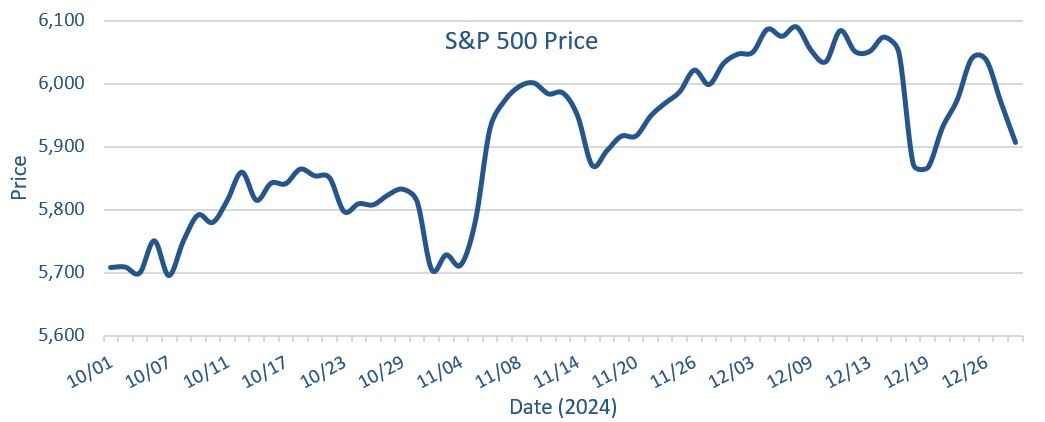

If you look at the returns produced by the S&P 500 index for the quarter ended 12/31/2024, you would likely assume it was an uneventful quarter. The S&P 500 index was up 2.39%[1] for the quarter, which is good, but not extreme. However, the market volatility during the quarter told a different story.

Source: Bloomberg LP as of 12/31/2024

In our last quarterly review, we suggested the quarter would be somewhat light on catalysts and the market would react to negative economic data negatively and vice versa. We believe this hypothesis largely held true. The first catalyst in the quarter did not happen until October 30th, when Q3 Gross Domestic Product (“GDP”) was announced and came in below expectations. The market reacted as expected to this negative economic news. The next catalyst was the U.S. Presidential election. We thought the reaction would be muted and it largely was. The S&P 500 was up 3.80% in the days that followed the election. Shortly after the election results became known, the Federal Reserve (“Fed”) met on November 7th. We believe the market had little reaction to the Fed meeting simply because nothing unexpected happened. However, that was not the case for the second Federal Reserve meeting of the quarter, which ended up being the final market catalyst of the quarter. From this meeting, the Fed announced a 0.25% interest rate cut, as forecasted, but Jerome Powell talked about potentially slowing the pace of cuts in 2025 because the economy is doing well. The market reacted negatively, with the S&P 500 falling 3.03% in the following two days.

Overall, 2024 was another significant year for market performance, similar to 2023. The S&P 500 index ended the year up 25.02% after being up 26.29% in 2023. That is one of the strongest two-year performances by the index in recent history. It has many investors wondering if the market is poised for a decline in 2025. However, keep in mind that the index was down 18.11% in 2022 which means the annualized 3-year return for the index is 8.91%–within the historical range. There have been a few instances where the index experienced two years in a row of over 20% returns. The most recent was the late 1990s where the index was up five years in a row with 20%+ returns followed by three down years. Before that it was 1982 and 1983 which was followed by 1984 when the market was up 6.27%. We could look at several other instances, but they generally point to the same idea. The market does not need to do anything in reaction to recent returns. It could go up, down, or sidewise in 2025. In our opinion, there is very little predictive power when looking at past returns.

Before we move on, let’s briefly discuss the election. While at a high level, the market had a muted response to the election results, as we anticipated, individual companies and specific industries generally had much larger reactions. For example, Green Brick Partners (GRBK), a publicly traded US home builder, fell 21.96% from the election day to the end of the year. Stanley Black and Decker (SWK) which is somewhat correlated with construction fell 16.20% from election day to the end of the year. On the other side, crypto currencies generally saw large increases. Coinbase Global (COIN), a crypto currency exchange, was up 28.01% from election day to year end. So, while we feel comfortable with our forecast on the overall market movement, that doesn’t mean there wasn’t opportunity within certain industries and stocks to capture returns due to sharp reactions to the election results.

In the aftermath of the U.S. presidential election, bond yields rose sharply in response to evolving market sentiment. Investors appeared to be reacting to potential shifts in fiscal policies, such as increased government spending or tax reforms, which could stimulate economic growth. These expectations drove inflation concerns, which were further influenced by discussions around potential tariff measures. The possibility of tariffs seemed to heighten market uncertainty, as tariffs may increase the cost of imported goods, potentially leading to higher consumer prices and impacting inflation expectations. This movement in yields likely reflected the market’s initial attempt to price in these dynamics.

What we’re watching:

The Fed has begun cutting the policy rate but recently indicated it will not be overly aggressive in doing so. Inflation seems to be slowing but has not yet come down to the Fed’s target. Looking ahead, the focus may shift to how tariff decisions and their impact on inflation might shape the Federal Reserve’s policy stance. If tariffs materialize and drive-up inflation, bond yields, including the 10-year Treasury, could rise further as the market anticipates a response from the Fed. The central bank could face a challenging environment, balancing inflationary pressures with the need to support economic growth. Conversely, if tariffs or other trade disruptions weigh heavily on economic activity, the Fed might adopt a more cautious approach. We believe these crosscurrents will be critical to monitoring how bond yields evolve and how they reflect the interplay between inflation, growth, and monetary policy in 2025.

Republicans will have majorities in both houses of Congress, the Supreme Court, and a Republican in the White House. As we look forward to the next quarter and year, we ask ourselves: what will be the positive and negative catalysts that move the market? We also think about what the market could be looking forward to or potentially dreading. All of that is difficult to answer in this scenario. We do think that legislative changes are likely and may be perceived as both positive and negative by the market. The Fed could surprise to the upside with more aggressive rate cuts than expected, but that seems unlikely. What we believe will be the primary catalyst for the year is overall economic performance. If the economy heats up the market is likely to do well. If the economy stalls, the market is likely to fare poorly. We tend to be optimistic on the U.S. economy so if we had to guess, we would lean toward markets doing well in 2025. Only time will tell.

Should you have any questions or want to discuss potential investment options, please call 1.877.524.9155 or visit SRHfunds.com for more information.

[1] All market data sourced from Bloomberg LP, as of 12/31/2024.

Past performance does not guarantee future results. Investing involves risk, including the loss of principal.

Definitions:

S&P 500 Index: The S&P 500 is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S., designed to measure the overall performance of large-cap U.S. stocks and often used as a benchmark for the broader U.S. equity market performance.

One cannot invest directly into an index.

10-Year Treasury: The 10-year Treasury is a U.S. government bond maturing in 10 years, reflecting long-term interest rates and economic outlook.