2025 Q2 In Review: Market Resilience Amid Policy Uncertainty

What we saw:

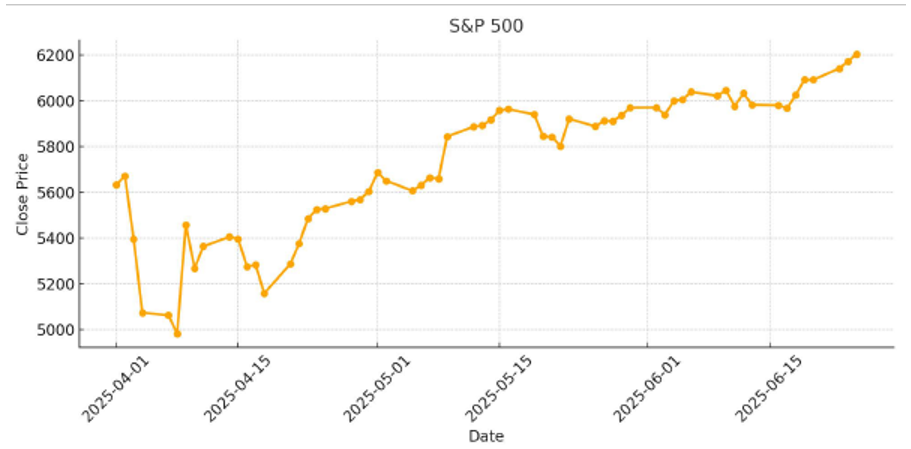

The second quarter began with major market turbulence. On April 2nd, President Trump announced an executive order imposing widespread tariffs on most countries. The next day, the market began a quick drop with the S&P 500 Index falling 4.84% on April 3rd, 5.97% on April 4th, and falling as much as 4.71% during early trading on April 7th before recovering later in the day. On April 9th, the White House announced a postponement of the tariffs for 90 days to allow time for negotiations. This news triggered one of the strongest single-day gains in market history, with the S&P 500 up 9.52%. Market volatility persisted for a couple of weeks as investors reacted to tariff negotiation updates and Federal Reserve commentary about how tariffs might affect inflation. A brief public disagreement between President Trump and Federal Reserve Chair Jerome Powell added to market uncertainty.

Starting April 22nd, the market began a rally that lasted through the end of the quarter. From April 21st to the close on June 30th, the S&P 500 Index gained 20.61%. The quarter ended with the S&P 500 Index up 10.94% overall, reaching a new all-time high on June 27th.

[1] All market data sourced from Yahoo Finance, as of 6/30/2025

What we’re watching:

Looking forward, the last week of July could bring significant market volatility. Two major events are scheduled back-to-back: a Federal Reserve meeting and President Trump’s tariff announcement. The market appears optimistic that both the Federal Reserve will cut interest rates and tariffs will be avoided. However, we think it’s more realistic that only one of these favorable outcomes will happen – a Fed rate cut or further tariff relief. If neither occurs, markets could respond quite negatively.

Normally, the Federal Reserve bases decisions on inflation and employment data. However, we believe they will be cautious about making changes while tariff uncertainty remains. If trade negotiations conclude before their meeting, reducing tariff uncertainty, the Fed might feel more comfortable cutting rates given the positive economic conditions of falling inflation and unemployment.

We expect tariff negotiations to continue throughout the quarter, with announcements of country-specific agreements and negotiation strategies. The market impact will depend on several factors for each country: trade volume, level of tariffs, and which specific goods are being taxed with each country. Outside of the “big week” mentioned earlier, the quarter could see high volatility with little overall change in market direction.

That covers just the first month of the quarter, and we continue to believe that taking a long-term view is more beneficial for investors. While near-term volatility is likely, we remain bullish about the stock market. Historically, equities have delivered strong long-term returns, and we expect them to continue being a cornerstone investment for long-term investors.

Should you have any questions or want to discuss potential investment options, please call 1.877.524.9155 or visit SRHfunds.com for more information.

[1] All market data sourced from Yahoo Finance, as of 6/30/2025

Past performance does not guarantee future results. Investing involves risk, including the loss of principal.

Definitions:

S&P 500 Index: The S&P 500 is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S., designed to measure the overall performance of large-cap U.S. stocks and often used as a benchmark for the broader U.S. equity market performance. One cannot invest directly in an index.