2024 Q1 In Review: Will Anything Slow This Train?

What we saw:

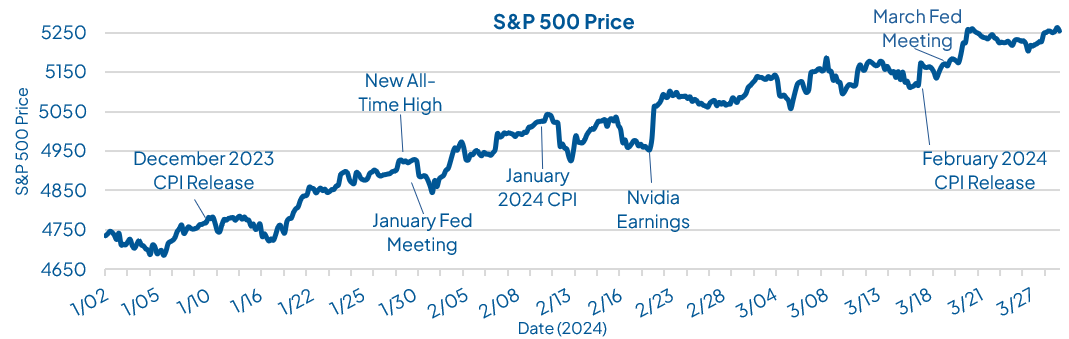

From our vantage point, Q1 2024 started similar to Q4 2023. There was some weakness in the equity markets, and it was as if investors were asking “is this it?” or “has the rally ended?” In early January, the consumer price index (“CPI”) report, a common measure of inflation, came in higher than anticipated. The inflation level reported was 0.3% for the month and 3.4% for the year, compared to expectations of 0.2% and 3.2%, respectively. One of the difficulties with persistent higher than expected inflation is that it leads investors to believe that the Federal Reserve will maintain the current Policy Rate for longer. Coming into the year, the market seemed to have an optimistic view of how many times the Fed would cut interest rates and when it would start. That optimistic narrative appeared to have been challenged by the CPI report, but only for a few hours. The market dipped in the morning when the report was published but recovered by the end of the day. Only about a week later, the market was bounding higher, seemingly forgetting the inflation numbers altogether.

On January 29th, the S&P 500 hit a new all-time high. Contrary to conventional wisdom, a new high is typically considered a bullish signal. Instead of saying “we hit a new high, so it is time to take gains and sell,” it is often advantageous for investors to remain in the market. A good bull market will experience many new all-time highs, and therefore it is usually foolish to sell at the first one. In this case, the bullish signal ran into the Federal Reserve meeting two days later in which the Fed attempted to talk down the optimism in the market (see 2023 Q4 In Review). Again, it only worked for a few hours. The market dipped after the Fed meeting but started to recover the next day and again hit new all-time highs just a couple days later.

The theme of unrelenting optimism seemed to be in full swing by the start of February. This is similar toQ4 2023 which saw the market rise considerably in the last two months of the quarter.

The January CPI numbers came out on February 11th; again, higher than expected with the monthly change at 0.3% and the yearly change at 3.1%. This is relative to economist expectations of 0.2% and 2.9%, respectively. Some might look at the 3.1% annual change and see that it is lower than the 3.4% annual change from the month before and infer that inflation is coming down and the outlook improving. While there is some truth to that, the main reason the annual number dropped was because CPI was 0.5% (relatively high) in January 2023 and that month is no longer considered in the 12-month figure. The 0.3% monthly figure released in February annualizes to around 3.6% per year inflation. With this being the second month in a row with a 0.3% monthly figure, the hope for a Policy Rate cut by the Fed in May seemed to be dashed. The market reacted negatively and experienced the worst day of the quarter. Even so, market optimism quickly prevailed over this momentary pullback. On February 22nd, the market hit another new all-time high seemingly led by Nvidia (NVDA) which reported better than expected numbers in its earnings report.

March saw more optimism and the market continued higher. The February CPI numbers came out on March 12th. The numbers were high at 0.4% for the month and 3.2% for the year, but this was closer to expectations than the previous month’s. The market was up that day and continued to rise unabated. The Federal Reserve had its second meeting of the year on March 20th. The Fed confirmed its intention to cut the Policy Rate before the end of the year and the market reacted bullishly. March finished strong and the S&P 500 was up 10.6% for the quarter.

What we’re watching:

One theme in the market continues to be unrelenting optimism, even in the face of mediocre or even cautionary inflation data. Looking forward, we generally expect this optimism to continue. At the beginning of the quarter, the market had expectations for 5-6 rate cuts by the Fed while the Fed’s dot plots had 3-4 cuts. The market’s expectations are down to 2-3 cuts at the end of the quarter. This change in market expectations should be bearish sentiment, but the market rose 10.6% over that time period. Therefore, we find it hard to say that a bad inflation report or strong words from the Federal Reserve in the future would be enough to cool optimism, because they have not in the recent past.

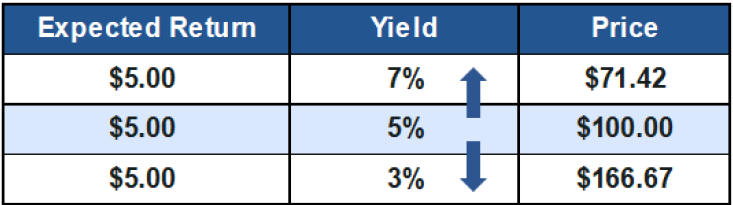

It might seem odd that the stock market would care so much about the Federal Reserve Policy Rate. After all, the Policy Rate only directly impacts overnight lending between banks. The primary reason it impacts the equity markets is because yields compete with one another. If the stock market is providing an expected return of 5% with significant volatility and cash (via the overnight lending rate) is also providing 5% with no volatility, most rational people will choose cash because it is the safer option. To attract investors, the stock market needs to provide a higher expected return in exchange for the higher volatility.

In the current environment, most market participants are excited for the Policy Rate to be reduced by the Fed because the expected return of the stock market can come down as well. If the Policy Rate is reduced to 3% then the stock market could remain attractive with just a 5% expected return. Since yields are inversely related to prices (see graphic below), a 7% expected return on stocks falling to 5% means stock prices should go up. These numbers are hypothetical, but the concept holds true. That said, we find it odd that the market continues to climb so rapidly without inflation slowing further or the Fed reducing rates. That is why we call this a season of optimism. It seems as if the market is already pricing in a rate reduction, even as economists continue to revise their rate cut predictions further into the future.

Obviously, other factors contribute to market returns. Earnings growth for the S&P 500 was 4% in 2023 and is expected to be 9.5% in 2024. That is around 13.9% compounded, but the S&P 500 is already up 39.6% since the beginning of 2023. Even adding another 4% for inflation does not explain the 39.6% return so far. Another, less quantifiable factor, is an expected productivity increase impacting the US economy from the development of artificial intelligence. Ultimately though, we believe optimism is a large factor in the strong returns we’ve seen recently. As we look forward, we will be paying attention to inflation reports and what the Federal Reserve says, but more importantly we will be paying attention to how the equity markets react to those events. A negative signal we’re keeping an eye out for is if the pullbacks last longer and the rebounds are smaller in magnitude. That could be a signal that optimism is waning; only time will tell [1,2].

Past performance does not guarantee future results. Investing involves risk, including the loss of principal.

This blog is created and authored by SRH Advisors, LLC (“SRH”) and is published and provided for informational purposes only. The opinions expressed in the blog are our opinions and should not be regarded as a description of services provided by SRH or considered investment, legal or accounting advice. Certain information sited is from third-party sources and while we believe the information to be accurate and true to the best of our knowledge, we cannot guarantee its accuracy as there may be certain unknown omissions, errors or mistakes. Use of third-party information, including links, is in no way an endorsement by SRH. The views reflected in the blog are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product or investment strategy is suitable for any specific person. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by SRH), or any non-investment related content, made reference to directly or indirectly in this blog post will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Not all SRH clients and investors will have the same experience within their portfolio(s) and certain topics discussed in this blog may not apply to all clients or investors. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SRH is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of SRH’s current written disclosure statement discussing our advisory services and fees is available upon request.